Hartley News Online Your alumni and supporter magazine

Earlier this week, the University successfully issued a £300m public bond, enabling it to strategically invest in its student and staff experience, facilities and infrastructure.

We also announced that we aim to invest a further £300m in the University over the 10 years, coming from our existing cash resources, our annual financial surplus generation and external sources. Southampton Connects Staff looks at the process leading up to the bond issue.

Last year the University Executive Board (UEB) started working with N M Rothschild & Sons Limited, one of the world’s largest independent financial advisors, to explore the different funding options available to the University to help deliver the strategy. The decision was taken by the UEB, on 19 December, to explore in detail the issue of a public bond, with the full agreement of Council given in mid-January. A bond is essentially a long term loan, with a level of interest that is fixed for the entire term of the loan.

The Vice-Chancellor, Professor Sir Christopher Snowden explains more about the bond in this video.

Southampton is not the first university to have raised funds this way, with both Leeds and Cardiff issuing bonds last year, for £250m and £300m respectively. The Universities of Liverpool, Manchester and Cambridge have also raised capital through the issuing of public bonds in recent years to invest in their infrastructure.

Ian Dunn, Chief Operating Officer remarked on the work involved:

Rather unusually for this type of activity, which is often kept to a very few people, over 120 staff members were directly involved in supporting the process leading up to the bond issue. This evidence of true collegiality meant we were able to complete a very complex and highly technical process in a remarkably short period of time, thereby enabling us to ‘go to market’ in very favourable conditions.

One of the key steps in this bond issue process was to secure a credit rating, this was carried out by the credit ratings agency Moody’s. Representatives from Moody’s visiting on 16 February were given comprehensive presentations on all aspects of the University and the opportunity to visit its research and training facilities and meet members of staff. They said that their visit “provided an excellent overview of the diversity of the world class research and education provided by Southampton”.

Moody’s announcement of the credit rating included the following very positive statement about the University:

[Southampton’s] already strong market position is expected to be enhanced by implementation of its current strategic plan, focused on incremental improvements across a variety of fronts as well as its extensive 10-year investment programme, which will result in improved teaching and research facilities, in addition to enhanced student facilities.

Following extensive analysis of the University’s financial position, Moody’s rated the bond as Aa2 — a high grade investment — the same rating as the existing bonds of the Universities of Leeds, Cardiff and Liverpool.

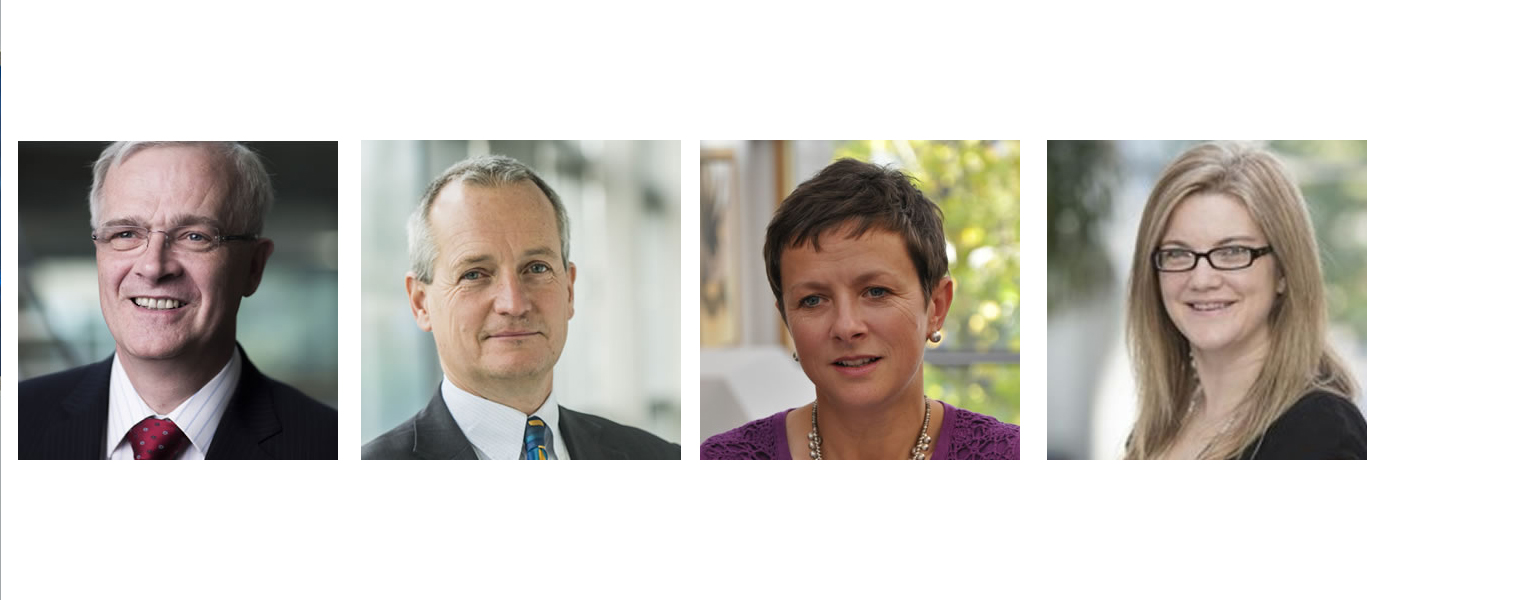

An investor roadshow was the next step in the process, held on 30/31 March in London and 3 April in Edinburgh. Sir Christopher Snowden, Ian Dunn, Sarah Pook and Julie Fielder presented to an invited audience of fund managers and potential investors, explaining our ‘Simply better’ strategy and giving an opportunity for them to clarify the content of the formal ‘prospectus’ provided to support their investment decision.

Pictured above – the roadshow presenters

LtoR: Vice-Chancellor, Professor Sir Christopher Snowden; Chief Operating Officer, Ian Dunn; Executive Director, Finance and Planning, Sarah Pook; Director of Finance – Planning and Analytics, Julie Fielder.

Talking about the roadshow, Ian said the following quote by HSBC Bank summed up the reception the University received during the intense three day investor roadshow, where we introduced the University to the investor market:

Investors recognised Southampton’s attributes as an elite research and education institution with a national and international reputation.

The final step in the process was to actually issue the bond. Representatives from the Banks managing the sale of the bond — known as ‘bookrunners’ — were involved in a phone call with the University’s bond team on the morning of 4 April. They jointly decided that the market conditions were right and that investor confidence, following the roadshows, was high.

At 09:00 on 4 April the ‘book’ (a list of the potential investors) was opened and was expected to remain open until 16:00. However, by lunchtime the bond was significantly oversubscribed with buy offers in excess of £465m, with a mix of high-quality investors, and the book was closed early.

Ian commented:

The outcome of this reception (from the market) was that we priced a highly successful GBP300m, 40-year debut bond issue with a fixed interest rate of 2.250 per cent, per annum. This is comfortably the lowest ever achieved in the public bond market by a UK university; lower than the interest rate achieved by Cardiff (3.000 per cent), Leeds (3.125 per cent), Cambridge (3.750 per cent), Manchester (4.250 per cent) and Liverpool (3.375 per cent). All new issuers also pay a premium on their first issue and Southampton’s was the second lowest new issue premium, only just behind Cambridge.

In summary, Ian went on to say:

All in all, with a huge amount of work by many people, we have achieved a great outcome and one that I hope all at the University can be proud to be associated with. We proved, frankly, that together we are ‘Simply better’ and we now have a platform from which to bring the strategy to life — in so many ways. I am hugely enthused that we will continue changing the world for the better with this generational opportunity to reshape the University for the future.

More information will be available at the next Vice-Chancellor’s All-Staff Address on 2 June.